refund for unemployment taxes 2021

How To Prepare For Your 2021 Tax Bill. IR-2021-159 July 28 2021.

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

If an adjustment was made to your Form 1099G it will not be available online.

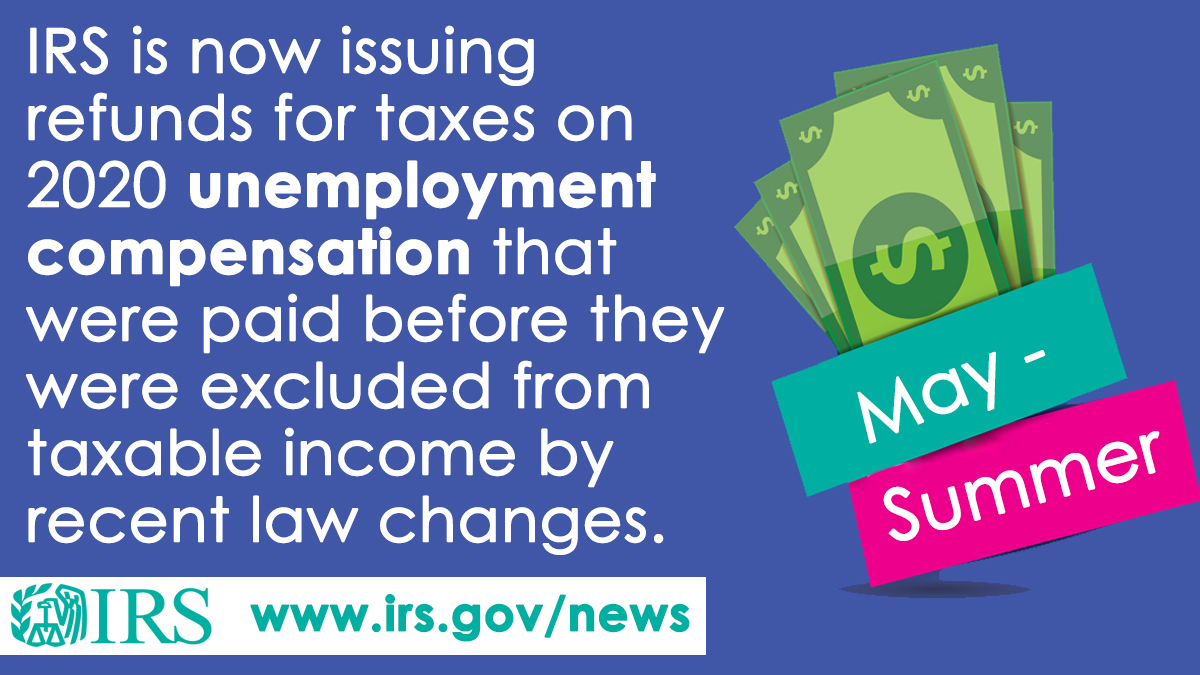

. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. There are two options to access your account information. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. The American Rescue Plan Act of 2021 offered relief to people who received unemployment compensation in 2020 at the height of the pandemic when companies were laying off millions. Yes the value of leave donated in exchange for amounts paid before January 1 2021 to organizations that aid victims of COVID-19 is excludable from an employees income for.

If you see a 0. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Ad Learn How To Track Your Federal Tax Refund And Find The Status Of Your Direct Deposit.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in 2020 unemployment compensation from taxable income calculations. Form 1099G tax information is available for up to five years through UI Online. Everything is included Premium features IRS e-file 1099-G and more.

You have the option of having income tax withheld from your unemployment benefits so you dont have to pay it all at once when you file. The IRS has promised to refund any taxes paid on the first 10200 of unemployment benefits earned last year but has said the money will go out this spring and. If you use Account Services.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. This summer frustrated taxpayers spoke out over tax refund delays after the IRS announced the cash for unemployed Americans.

Your Social Security number or Individual. Account Services or Guest Services. 24 and runs through April 18.

See How Long It Could Take Your 2021 State Tax Refund. The federal tax code counts. Current federal law provides employers with a 54 percent FUTA tax credit and no FUTA tax credit reduction will occur in 2022 for wages paid to their workers in 2021.

The American Rescue Plan Act of 2021 enacted in March excluded the first 10200 in unemployment compensation per taxpayer paid in 2020. Many people had already filed their. Tax season started Jan.

The 10200 is the amount. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it. IRS sending unemployment tax refund checks The law that made up to 10200 of jobless income exempt from tax took effect in Mar.

Households whove filed a tax return and are. California does have an. You may check the status of your refund using self-service.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Confused About Unemployment Tax Refund Question In Comments R Irs

1099 G Unemployment Compensation 1099g

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2021 Unemployment Benefits Taxable On Federal Returns King5 Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Irs Unemployment Refunds Moneyunder30

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Interesting Update On The Unemployment Refund R Irs

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Stimulus And Taxes How To Shield Up To 10 200 In Unemployment Benefits From Income Taxes Syracuse Com

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Xgvjz1gws7